FAQs

Q. How long has the Town known about this shortfall?

A. Municipal budgets are composed nearly a year in advance. The FY24 budget process began in November 2022 and a shortfall was quickly recognized. The Town Administrator, Finance Team and the Department Heads sharpened their pencils and cut from various line items. In January 2023, the interim Finance Director, Town Account and Town Administrator sat with department heads and again made further reductions. The proposed $450,000 override amount is still the shortfall after making those cuts, even after removing the OPEB (other post-employment benefits) funds from the operating budget.

Q. Were there any warning signs concerning the Town’s budget shortfall?

A. Since at least 2020, the Town’s salary and operating budget have had shortfalls. Previously, Town Meetings had addressed the situations by supplementing the budget with free cash (retained earnings), which is poor financial practice because it does not reflect the Town’s actual costs. A household could not last long paying their mortgage from their tax returns or rainy day fund when their checking account does not have sufficient funds.

Q. Wasn’t the Town aware that we had contract raises that had to be met? Doesn’t the Town account for those contractual obligations each year along with anticipated cost of living increases?

A. Union contracts (7 total) are negotiated every three years. We negotiated fair contracts; to retain staff we need to pay fair competitive wages with benefits. Minimum wage is currently $15 an hour and wages have increased across the board.

Forecasting future salary obligations is a moving target. According to the Bureau of Labor Statistics, employee wages and the cost of benefits have increased 5% in 2023 alone. Our surrounding municipalities are always making adjustments to their compensation packages, leaving Fairhaven further behind its peers. The Town’s lack of competitiveness has caused high employee attrition and the inability to hire new candidates. For example, prior to the new fire contract, our firefighters were being paid 9% less than the average of our comparable communities. Additionally, the Town hired HRS Consulting to review our non-union employee wages and it was determined that our department heads were making at least 20% less than fellow communities with similar demographics.

With the Town only able to increase taxes by 2.5% each year, the override is a necessary response to the increased costs to the job market, employee benefits, and the 8% increase to inflation seen in 2022.

Q. If the override fails, what cuts will be made?

A. The Town Administrator has determined that the School District will be reduced by $200,000 and municipality by $250,000. The Commonwealth's finance statute, Chapter 70 of MGL, establishes an annual net school spending requirement for each Massachusetts school district. Failure to comply with this requirement may result in further action by the State, including but not limited to the non-approval of a municipality's tax rate, enforcement action by the Attorney General, or loss of state aid. In 2020, the Town funded our schools at 105% to net school spending, while the State average is 125%. The School Department and Board have stated that $200,000 will fund social service initiatives such as the Family Center, and maintain youth activities such as the Unified Sports Team and Middle School Athletic Program among other activities.

With a proposed $250,000 cut to the Town, employee salaries will remain twenty percent below our comparable communities. Additionally, the Administration will determine budget cuts that will affect all departments (Town Hall, Highway, Fire, Police, etc.). Cuts inevitably lead to higher employee turnover and increase costs in the long run through the need for contracted services to support departments in the interim. The Town Administrator, working in conjunction with departments, will determine priorities and what services need to be cut.

Q. Were the “powers that be” aware that this was going on? Did the Town Meeting have any role in approving this action? Was there oversight?

A. Each Town Meeting since 2020 has supported the use of free cash to cover the shortfall in revenue that funds the operating budget. Covid was an unprecedented situation. During this period the Town was not sure what local receipts (revenue) or State/federal aid would be made available. Inflation, the increased cost of services and the continual reliance on free cash does not help our financial situation.

Q. How much will this cost me?

A. Approximately $0.11/ $1000 of the Town’s assessed property value per year. As of 2023, the average tax-assessed home value in Fairhaven is $394,058. This means the average tax increase per property would be $43.35. Go to the override calculator to see how the override will affect the property tax on your home.

Q. Has Fairhaven ever done an override?

A. Just once in fiscal year 1991, which attempted to raise revenue to support the Town’s special education programs.

Q. If the override passes can the town raise taxes at higher than 2.5% in future years?

A. An override resets the baseline for taxes for the year it is requested. If an override passes, the future tax increase will automatically go back to the standard 2.5% as mandated by law. The ask is for $450,000 for this year only (FY24). Voting yes for an override does not change the tax increase for future years without the approval of Town voters.

Q. Will this have to happen again next year?

A.The Finance Team is hopeful this override will right the ship and will not require additional overrides in the near future, if all things stay the same. Changes we cannot account for include a recession, loss of revenue, changes to cannabis regulations, etc.). Unfortunately, town budgets are susceptible to factors outside of a municipality's control. Taking no action would absolutely exacerbate the problem and result in the need for a larger override or significant service cuts in the future. Small incremental change is better than a large tax increase all at once in a future year.

The Town will also be looking for additional opportunities to increase revenue and reduce expenses with efficiencies.

Q. Didn’t my property value increase tremendously over the last few years?

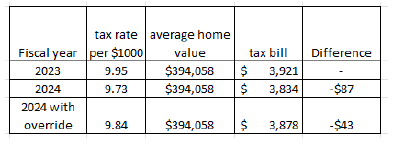

A. Home values in Fairhaven have increased but the Town’s property tax rate has decreased over the years. Taxes can only increase by 2 ½ percent each year. For 2023, the residential tax rate is $9.95. In 2024, the estimated rate is expected to be $9.73 and with an override, it would be $9.84. The 2024 tax rate with an override will be less than what residents are paying now. As of 2023, the average tax-assessed home value in Fairhaven is $394,058. This means the average tax increase per property would be $43.35. In most cases, the tax bill will actually decrease. This is because we have some debt coming off the books.

Q. How will we increase revenues?

A. New growth is the answer. Unlike personal finances, municipalities are limited in their ability to raise and use funds. Towns must pay their bills and cannot get an alternative source of income without authorization. Current initiatives to increase the tax base include the 40R zoning project, reassessing departmental fees to ensure we are aligned with other local communities, and the implementation of our short term rental by-law.