What are the Current Tax Rates in Fairhaven?

For fiscal year FY24, the residential tax rate is expected to be $9.73 per $1,000, based on the assessed value. The median assessed home value is expected to be $368,550. With the override, for the fiscal year 2024, the residential tax rate is expected to be $9.84 (per $1,000) on the assessed value, that's an addition of only .11 cents.

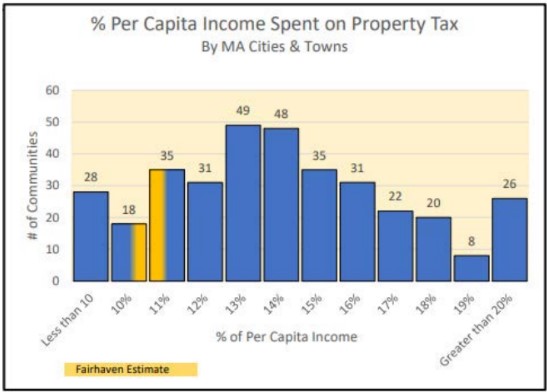

∗ Taxpayers in 90% of municipalities in the State spend more of their per-capita income on taxes than Fairhaven residents.

∗ The average property tax bill in Fairhaven is $3,834. The State average is $6,724.

Town of Fairhaven Historical tax rates