How Will a Tax Override Affect My Taxes?

In order to understand how your property tax is calculated, and how the proposed override would change your property tax bill, you will need to know the assessed property value. A property's tax-assessed value is different from what you find on Zillow. A real estate agent will usually list a house on the market at a higher price than the value determined by a municipality. To find your property's assessed value, please enter your address in the search bar through this link.

Once you have the assessed tax value of your home, you can use the following calculator to see what the tax increase would be for your property. The proposed override increase is $.11 cents per $1,000 of property value.

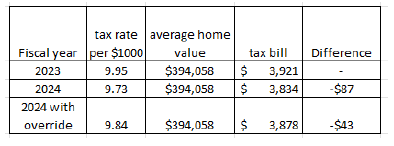

For 2023, the residential tax rate is $9.95. In 2024, the estimated rate is expected to be $9.73 and with an override $9.84. The 2024 tax rate WITH an override will be less than what residents are paying now.

Calculator Instructions: Insert your home's assessed property value in the top line of the calculator to see the change in your property tax.

Please Note: This calculator is an average result based upon the most current assessed property values and an estimated 6% increase in property valuations for 2024.

As of 2023, the average tax-assessed home value in Fairhaven is $394,058. This means the average tax increase per property would be $43.35. In most cases, the tax bill will actually decrease. This is because we have some debt coming off the tax rolls.